Is it possible to send a board member on a business trip if he does not receive any payment?

Even if a board member is not paid to run the company, he can be sent on official business trip.

Travel order

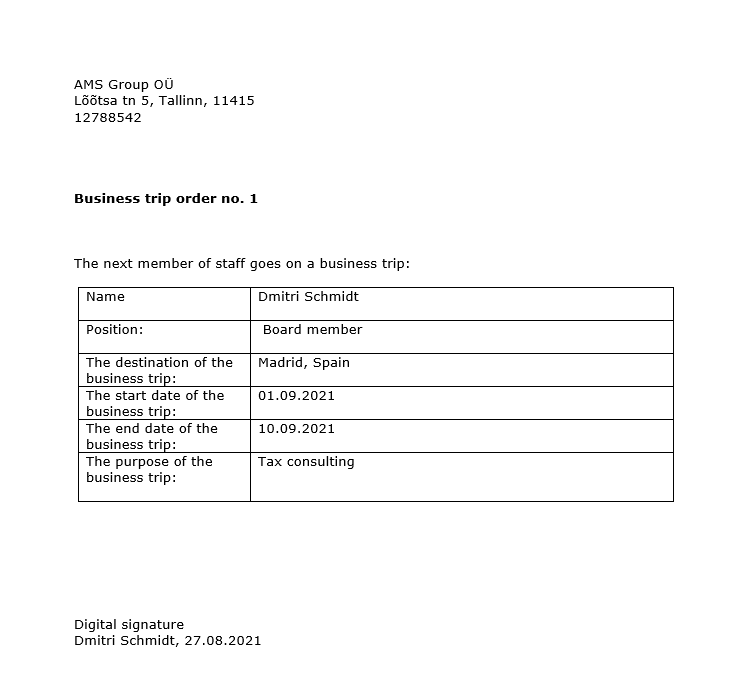

To send a board member on a business trip, the first thing to do is to draw up and sign a travel order.

You can upload a template for a travel order here.

Please upload the file and fill it in by writing your data in place of the explanations enclosed in square brackets.

Afterwards, sign the application using the e-Residency card and upload it to Nola Accounting.

Order sample

When should the order be made?

It is better to make an order as soon as you have purchased your round-trip tickets.

Business trip report

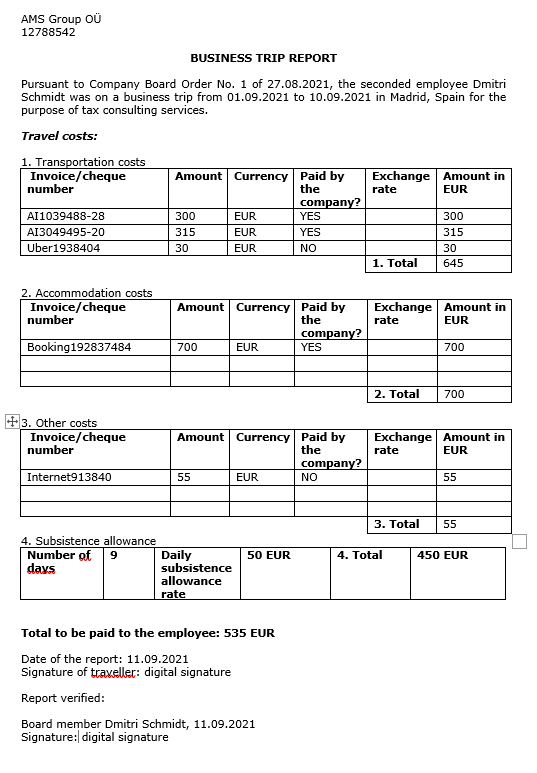

After a business travel, a business trip report must be drawn up and submitted to a board member for approval.

NB! If the company has one board member and he/she has travelled, then he/she is the one who draws up the report and approves it.

The travel report template can be uploaded here.

Download the template and fill in the travel report. Then sign it using the e-Residency card and upload it to Nola Accounting.

NB! Please upload all the invoices and receipts that appear in the report together with the travel report.

Sample report

Note

The column "Paid by the company" is needed to understand which invoices have already been paid from the company account and which from the traveller's personal funds. It is possible to reimburse the traveller for invoices and cheques that have been paid from the traveller's own funds.

When should a business trip report be drawn up?

The business trip report should be completed within 5 days of the end of the business trip.

Extra information about the business trip report

Travel expenses

Travel expenses are divided into 4 groups in the report:

1. Transport costs (e.g. airfare, taxi, bus, train, ferry).

2. Accommodation costs (e.g. hotel invoices, invoices from Booking.com and similar services).

3. Other expenses (this includes all expenses not included in the first two groups, e.g. office supplies, SIM card, internet, etc.).

4. Per diem (as a rule, per diem is paid for food, but the traveller can spend it on anything and is not obliged to account for it.

Amount of Daily Subsistence Allowance

If the board member of an Estonian company resides in Estonia, the amount of the daily subsistence allowance is established by the law of the Republic of Estonia.

You can pay up to €75 per day for the first 15 days without tax, up to €40 for the next 15 days.

NB! If the board member does not reside in Estonia, he or she should be guided by the laws of the country where he or she is a tax resident when paying the per diem.

Reimbursement of travel expenses

The seconded person is reimbursed for expenses paid from his or her own funds. If the expenses have already been paid with the company card, they cannot be added on again.

Payment of subsistence allowance and compensation for business trips

The per diem and travelling allowance shall be paid in a separate transaction. The payment amount should be the same as the payment amount stated in the report. The payment explanation can be written as follows: business trip report 1.